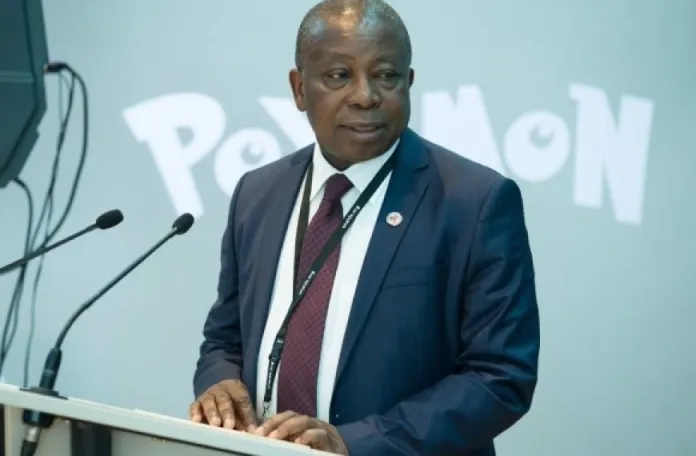

Mr Kwaku Agyeman Manu, the Board Chairman of the Nkrankwanta Rural Bank in the Bono Region says the bank’s total deposits rose from GHC27,867,185 in 2023 to GHC58, 332,539 in 2024, registering a staggering growth of 108 percent.

He said the bank’s total assets also grew by 111 per cent from GHC32,027,825 to GHC68, 492,087 within the period, adding that it paid GHC250,000.00 dividends enabling shareholders to buy more shares.

Mr Manu disclosed this in his address at the Annual General Meeting (AGM) of the bank at Nkrankwanta in the Dormaa West District, saying the bank had paid the second dividends, an indication of growth and sound financial stability.

He said the bank’s short-term investment in in treasury bills also jumped by 220 percent from GHC15, 226,510 in 2023 to GHC48,728,091 in 2024, saying that it’s profit before tax also increased from GHC1,913,811 to GHC2,176,761 a representation 14 percent increase.

The bank’s share capital also saw a marginal growth from GHC1,290,193 in 2023 to GHC1, 378,107 in 2024, representing seven percent increase, he stated saying its net-worth grew by 50 per cent from GHC3,165,229 in 2023 to GHC4,739,135 in 2024.

Mr Manu said: “The bank made a provision of GHC733,333 for bad and doubtful debts,” assuring that the board and management of the would strengthen credit risk management practices and intensify the credit recovery efforts to prevent deterioration of credit portfolio.

He indicated that the bank appreciated the loyalty of its customers and shareholders, and pledged to adopt prudent strategies to further improve the bank’s deposits, saying it was imperative that the bank increased its share capital to the Capital Adequacy Ratio (CAR).

“The bank ended the year under review with a CAR of 22 per cent which is above the statutory requirement of 10 per cent and signaling resilience,” he stated and urged the shareholders to buy more shares.

He said: “The declaration of dividend payment comes against the back drop of stringent Bank of Ghana’s requirement in respect of dividend payments,” adding that “the locked-up investment of most Rural and Community Banks has still not been paid, hindering the bank from the needed growth and improved profitability”.

Mr Manu said in spite of those challenges, the bank was growing at a faster rate with strong fundamentals and clear growth trajectory and urged the customers to endeavour to pay their loans.

He said the bank had met the regulatory minimum capital of GHC1,000,000 and urged shareholders and customers to continue to invest in the bank.

Mr Manu said the bank also honoured its Corporate Social Responsibility programmes, donating quantities of cement towards the construction of a queen mothers’ palace at Nkrankwanta, 43 inches television and financial support to the Nkrankwanta Senior High Technical School among others.