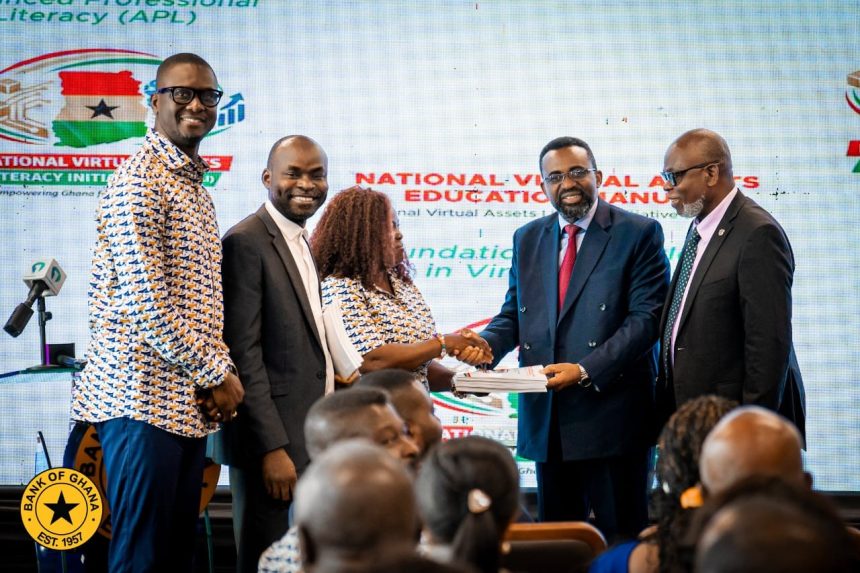

The Bank of Ghana, in collaboration with the Securities and Exchange Commission, has launched the National Virtual Asset Literacy Initiative (NaVALI) in Accra.

NaVALI is a landmark programme that signals Ghana’s deliberate, responsible, and forward-looking approach to the regulation and use of virtual assets.

Dr Johnson Asiama, the Governor of the Bank of Ghana, speaking at the launch on Friday, said there was a need to collaborate and educate the public on responsible adoption and usage of virtual assets.

The launch was on the theme: “Understand Before You Undertake.”

“At the Bank of Ghana, we acknowledge that effective regulation and enforcement cannot be achieved by regulators alone,” he added.

The Governor said the entire ecosystem must be prepared through a sound understanding of virtual asset activities, their implications, and associated risks.

“This underscores the need for public education, consumer protection, and regulatory preparedness. NaVALI meets this need,” he said.

Dr Asiama said the recent enactment of the Virtual Asset Service Providers Act marked a significant milestone in Ghana’s financial sector development.

The Bank and the Commission were focused on establishing structures, systems, and processes to ensure its operationalisation and address regulatory gaps and risks, he said.

The Governor emphasised that the launch of NaVALI formed the foundation upon which effective regulation, consumer protection, and sustainable innovation in virtual assets would be built.

Therefore, the Bank and the Commission, as the regulators designated under the Act, were currently focused on establishing the requisite structures, systems, and processes to ensure its timely and orderly operationalisation to address regulatory gaps and risks.

That imperative underscored an urgent need for public education, consumer protection, and regulatory preparedness, he said.

NaVALI is anchored on a simple but important principle: understand before you undertake– positioning virtual asset literacy as the foundation for a safe digital economy.

It was a carefully designed initiative led by the Bank, in collaboration with the Commission, and key knowledge partners from academia and industry.

The Governor said it was to strengthen institutional capacity on virtual assets and enabling technologies, particularly blockchain, to support effective regulation, supervision, and policy formulation.

It is also to promote nationwide awareness of the risks and implications of virtual assets, to discourage uninformed usage and risky adoption.

He commended the Virtual Asset Regulatory Office, its partner institutions, and all stakeholders who contributed to the development of the initiative.

“Your collaboration underscores the shared responsibility required to build a resilient and well-informed virtual asset ecosystem in Ghana, “he said, adding that its successful implementation requires sustained collaboration between regulators, industry players, educators, civil society, and the media.

He called on the public to participate, learn, ask questions, and engage responsibly.

“Financial innovation can only serve national development when it is anchored in knowledge, trust, and accountability,” Dr Asiama said.