The Finance Minister has in his 2026 budget signaled a decisive shift from crisis management to economic rebuilding, announcing aggressive growth targets, major tax reliefs, and a renewed commitment to fiscal discipline aimed at restoring stability and investor confidence.

The budget projects GDP growth of 4.8 percent, a fiscal deficit of four percent, and continued inflation decline — the clearest indication yet that government believes the economy has “turned the corner.”

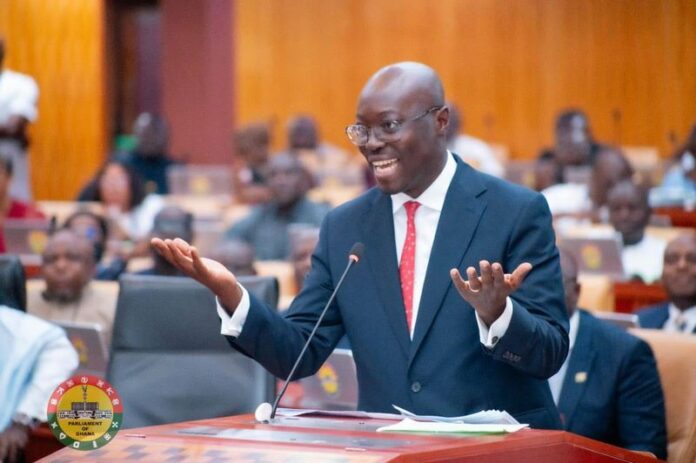

Presenting the budget statement in Parliament, Finance Minister, Cassiel Ato Forson said the budget “marks the beginning of a new phase, from stabilisation to recovery and renewal.”

He stressed that Ghana is moving away from years of economic shocks, high inflation, and weakened confidence, and is now positioned to grow on a more sustainable footing.“Our story is no longer one of crisis,” he said. “We have restored fiscal discipline, brought inflation under control, stabilised the cedi and rekindled investor confidence.”

The minister pointed to the dramatic fall in inflation (down to 8 percent year-on-year in October 2025, the lowest level since 2021) as evidence that the government’s stabilisation programme is working. With inflation easing, the Bank of Ghana recently reduced its policy rate to 21.5 percent, improving credit conditions for businesses.

A major highlight of the budget is the abolition of the COVID-19 Health Recovery Levy, which many businesses and households have long complained about.

Dr. Forson described the removal of the levy as “a relief that signals our transition into a new economic phase.”

The government is also planning an expansive jobs drive, projecting the creation of 800,000 jobs across public and private sectors in 2026.

Significant allocations were announced for infrastructure, education, and health, with over GHC86 billion earmarked for major roads and educational investments alone.

To sustain the recovery, the minister emphasised strict expenditure control and a renewed focus on domestic revenue. Government is targeting GHC268.1 billion in revenue and grants, relying on improved tax compliance, expanded digital tax systems, and stronger enforcement.

He also announced a crackdown on illicit financial flows, estimating that Ghana had lost over GHC11 billion through such leakages in recent years.

Another signal of confidence, according to Dr. Forson, is government’s plan to return to the domestic debt market in 2026 after years of limited access. “To our international partners and investors, Ghana is back — strong, credible, and open for business,” he declared.

The budget also pushes forward the administration’s industrialisation and digitalisation priorities, promising support for agribusiness, digital infrastructure, and high-productivity sectors that can absorb youth employment.

Opposition MPs, while welcoming the removal of the COVID levy and the job-creation pledges, raised questions about the realism of the revenue expectations.

They argued that Ghana has historically struggled to meet ambitious revenue targets and warned that unrealistic projections could pressure government into future borrowing.

Economists offered mixed but mostly positive reactions. Analysts praised the government’s clarity on deficit reduction and its commitment to staying within a narrow fiscal path. Some, however, cautioned that the budget’s success will depend entirely on implementation.

“A disciplined budget is only as strong as the government’s ability to execute it,” one analyst noted.

For ordinary Ghanaians, the immediate impact will come from the tax relief, expected public-sector hiring, and the promise of better macroeconomic stability. For businesses, especially those in manufacturing, construction, and technology, the budget’s message is that conditions for investment will continue to improve.

The 2026 budget is the first full-year financial blueprint under President John Dramani Mahama’s administration, giving it significant political weight. It marks a statement of intent: to move the country out of the turbulence of recent years and into a period of predictable, disciplined economic management.

Whether that vision holds will depend on the months ahead. But for now, the government is signalling confidence — and inviting the country, and investors, to share it.