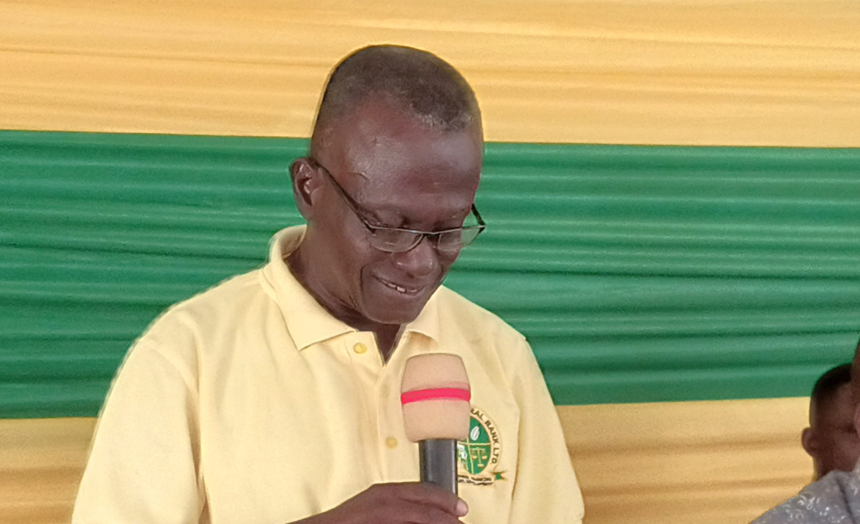

Professor Emmanuel Opoku Marfo, the Board Chairman of the Nsoatreman Rural Bank PLC in the Bono Region says the bank’s assets has seen growth from GHC59,033,907 in 2023 to GHC99,466,831 in 2024.

He said the bank was making significant strides in its financial performance, demonstrating resilience and operational efficiency despite broader economic challenges, saying its deposits increased from GHC51,843,381 in 2013 to GHC88,544,853 in 2024.

Prof Marfo disclosed this when addressing the 35th Annual General Meeting of shareholders at Nsoatre in the Sunyani West Municipality of the region and added that total loans and advances also grew by 92.11 percent from GHC16,785,556 to GHC32,246,550 within the fiscal period.

In 2024, the bank’s share capital rose by 31.39 percent from GHC2,017,582 in 2023 to GHC2,371,13 in 2024, he stated.

Nonetheless, Prof. Marfo said the bank required more share capital to enhance its solvency and risk absorption capacity to stand the test of time, and urged shareholders to increase their investments, assuring that such commitment would yield rewarding benefits in the near future.

He stressed the bank’s commitment towards strengthening its earning potential and expanding its growth opportunities, revealing that the bank’s investment in treasury bills and others increased from GHC32,147,515 in 2023 to GHC50,236,515 in 2024.

The bank recorded an impressive profit before tax of GHC3,332,633.00 during the year under review, representing a remarkable increase of 111.81 percent over the GHC1,573,4222.00 achieved in 2023.

“This outstanding performance was largely driven by prudent financial management, improved operational efficiency, and continued loyalty and confidence of our valued shareholders and customers,” Prof Marfo stated.

He said the Board of Directors of the bank had approved the payment of GHC220,000 as dividend to shareholders pending approval from the Bank of Ghana.

Prof. Marfo said during the year under review, the bank remained committed to its Corporate Social Responsibility and supported educational institutions with learning materials as well as provided sanitary pads to girls in schools within its catchment area at the cost of GHC56,076.00.

These initiatives contributed to the achievement of key Sustainable Development Goals (SDGs), notably, SDGs three, four and five of good health, quality education and gender equality respectively.

Prof. Marfo said in their quest to bring banking services closer to customers, the bank would, in the not-too-distant future, open a new branch in the Berekum Municipality to provide fully-fledged services to the people.

The Board Chairman pledged the bank’s commitment to continue to uphold the principles of strong corporate governance by adhering to the best practices in line with the central bank’s corporate governance guidelines for Rural and Community Banks.

Mrs Agnes Grimmon Insitful, the Chief Executive Officer of the Nsoatreman Rural Bank commended the Board, Management, staff, customers, and shareholders for their diverse contributions towards the growth and development of the Bank.

Nsoatreman Rural Bank witnesses impressive growth – Board Chairman