The year 2025 is etched in Ghana’s economic history as the moment the long-awaited reset truly began.

When the Mahama Administration assumed office, it inherited an economy burdened by inflation above 23 percent, interest rates exceeding 30 percent, a rapidly depreciating cedi, weakened investor confidence and unsustainable debt dynamics. The response was swift.

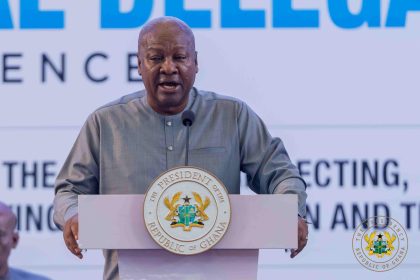

With clear political backing from President John Dramani Mahama, the Minister for Finance, Dr Cassiel Ato Forson, led a stabilisation drive aimed at restoring macroeconomic balance, rebuilding confidence and laying a firmer foundation for growth.

What follows are 20 key macroeconomic reforms and outcomes recorded in 2025 that collectively marked a turning point for Ghana’s economy.

Growth reignited

Economic activity rebounded strongly. Gross Domestic Product expanded by 6.1 percent in the first three quarters of 2025, compared to 5.7 percent over the same period in 2024, representing the fastest pace of growth since 2019.

Non-oil GDP growth accelerated to 7.5 percent, signalling broad-based expansion across sectors that generate the bulk of employment.

Inflation brought under control

Price pressures eased sharply during the year. Headline inflation declined from 23.8 percent in December 2024 to 6.3 percent by November 2025, the lowest level since February 2019.

Food inflation fell by 21.2 percentage points to 6.6 percent, while non-food inflation eased by 14.2 points to 6.1 percent. Inflation on locally produced items dropped from 26.4 percent to 6.8 percent, andimported inflation fell to 5.0 percent from 18.0 percent.

For households, the easing of inflation translated into restored purchasing power and relief at market centres across the country.

Interest rates ease sharply

Treasury bill rates declined dramatically from above 30 percent at the end of 2024 to about 11 percent in 2025. The reduction lowered government borrowing costs and improved credit conditions for the private sector.

Cedi records rare appreciation

For the first time in several years, the cedi posted an annual appreciation against all major trading currencies. It gained 40.7 percent against the US dollar, 30.9 percent against the pound sterling and 24.0 percent against the euro, reversing the steep depreciation experienced in 2024.

External position strengthened

The trade balance recorded a surplus of US$8.5 billion by end-October 2025, compared to US$2.8 billion a year earlier. The current account also improved, posting a surplus of US$3.8 billion in the first three quarters, up from US$0.6 billion in 2024.

Gross international reserves increased to US$11.41 billion, equivalent to 4.8 months of import cover.

Debt turnaround achieved

Public debt declined from GH¢726.7 billion, representing 61.8 percent of GDP in December 2024, to GH¢630.2 billion, or 45.0 percent of GDP, by October 2025. The reduction ranks among the sharpest debt reversals in the country’s history.

Investor confidence returns

International confidence in Ghana’s fiscal management improved markedly. Fitch, Moody’s and Standard & Poor’s each upgraded Ghana’s credit ratings, marking the first triple upgrade in several years.

Fiscal discipline restored

Fiscal performance strengthened as the primary balance recorded a surplus of 1.9 percent of GDP by October 2025, triple the initial target of 0.6 percent.

Pro-growth reforms rolled out

A series of tax and structural reforms were implemented to stimulate growth and ease the cost of doing business. These included the abolition of the COVID-19 Levy, reduction of the VAT rate to 20 percent, restoration of VAT input deductions, an increase in the VAT registration threshold to GH¢750,000 and the zero-rating of textiles to 2028.

Fiscal rules were also tightened through amendments to the Public Financial Management Act, introducing a debt ceiling of 45 percent of GDP by 2034 and a minimum annual primary surplus requirement of 1.5 percent.

Several nuisance taxes, including the Betting Tax, Emission Tax and e-Levy, were abolished. Oil revenues, mining royalties and District Assemblies Common Fund transfers were redirected towards priority infrastructure under The Big Push, while at least 80 percent of transfers were channelled directly to local governments.

Financial sector reset

The financial sector underwent a broad reset. The National Investment Bank was recapitalised with GH¢1.92 billion, while total funds under management rose to GH¢85.53 billion.

The Ghana Stock Exchange Composite Index delivered a return of 27.82 percent, with trading volumes increasing by 146 percent. Fixed income trading rose by 51 percent year-on-year to GH¢108.23 billion.

Together, these outcomes reflect a decisive shift in Ghana’s economic trajectory in 2025. The challenge ahead lies in sustaining discipline, deepening reforms and ensuring that the gains recorded become a durable platform for jobs, growth and shared prosperity.