In recent years, investing in Ghana has moved from bank halls and broker offices to mobile phones With a few taps users can now buy treasury bills contribute to mutual funds save automatically or track returns in real time Digital investment apps have lowered barriers attracted younger investors and reshaped how ordinary Ghanaians interact with money

But convenience can also mask risk

As these platforms multiply so do questions about regulation safety fees and realistic expectations For first-time investors especially understanding what sits behind the screen is just as important as the ease of using the app itself

Why digital investment apps have taken off

The appeal is easy to understand Traditional investing in Ghana often felt intimidating and exclusionary Minimum investment amounts were high processes were paper-heavy and access required physical presence

Digital investment apps changed that They offer

Low minimum entry amounts

Mobile money integration

Automated saving and investing

Clear dashboards showing balances and returns

Simple language compared to traditional investment documents

For young professionals informal workers and diaspora Ghanaians these platforms feel modern accessible and empowering

But ease of access does not remove the need for caution

Regulation matters more than design

The most important question to ask before using any digital investment app is not how sleek it looks but whether it is properly regulated

In Ghana platforms that offer investment products should operate under licenses issued by the Securities and Exchange Commission or partner transparently with licensed fund managers Some apps are simply technology front-ends that distribute regulated products Others operate in grey areas

Being registered as a company with the Registrar-General’s Department is not the same as being licensed to take public investments

Before committing money users should be able to identify

The licensed fund manager or institution behind the product

The regulator overseeing the investment

Where client funds are held

Whether there is an independent custodian or trustee

If this information is hard to find or vaguely explained that is a warning sign

Understand what you are actually investing in

Many digital platforms market themselves as investment apps but the underlying products differ widely

Some offer

Treasury bills

Money market mutual funds

Fixed-income funds

Savings-style products linked to investments

Others use broad labels such as growth wealth or target plans without clearly stating what assets your money is invested in

Before investing it is essential to understand

Whether returns are fixed or variable

What assets generate those returns

What risks apply

How long your money is locked in

An app may feel simple but the investment itself still carries real-world risks

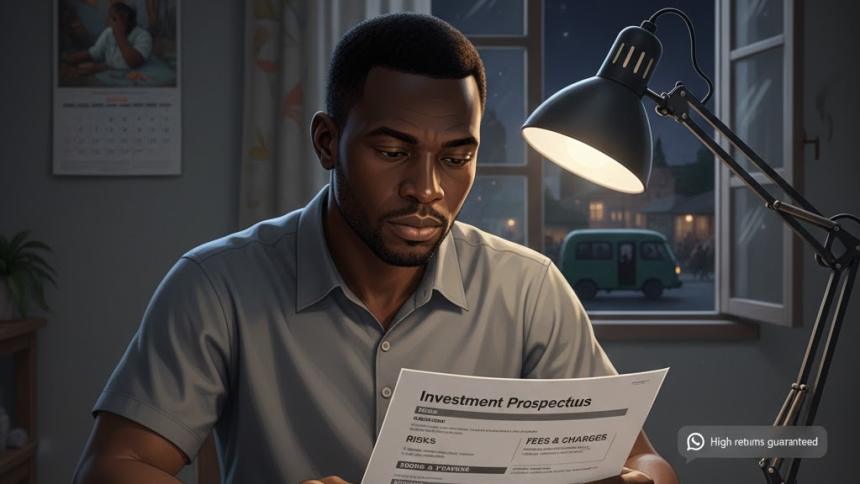

Guaranteed returns should raise eyebrows

One of the most dangerous assumptions users make is treating app-based investing as risk-free Some platforms use language that strongly implies guaranteed returns even when returns depend on market conditions

In reality legitimate investments fluctuate If an app promises high fixed returns regardless of inflation interest rates or economic stress users should pause

Digital delivery does not change the basic rules of finance Risk still exists even when it is hidden behind friendly graphics

Liquidity and access to funds are not the same everywhere

One of the selling points of digital apps is quick access But not all investments offered through apps are equally liquid

Some products allow withdrawals within hours or days Others require notice periods maturity dates or penalties for early exit

Before investing users should understand

How quickly money can be withdrawn

Whether withdrawals are guaranteed or subject to conditions

What happens during market stress or system disruptions

In Ghana’s recent financial history delayed redemptions have been a major source of anxiety for investors

Fees can quietly eat into returns

Digital platforms often feel cheap or free to use but fees still exist They may be embedded rather than obvious

These can include

Management fees charged by fund managers

Platform or service fees

Transaction or withdrawal fees

Mobile money charges

Even small annual fees compound over time and reduce real returns especially in low-risk investments where margins are already thin

A transparent app should clearly explain how it makes money

Technology risk is still financial risk

Digital platforms depend on technology System outages cyber risks app errors and data breaches are not theoretical concerns

Users should consider

Whether the app has strong security features

How customer complaints are handled

What happens if the app shuts down or changes ownership

Whether customer funds are ring-fenced from company operations

An app failing as a business should not mean your investment disappears with it That distinction matters

Behavioural risk investing becomes too easy

One overlooked risk of digital investing is behavioural When investing is effortless people may invest without thinking

Automated contributions can be powerful but they can also lead users to

Invest money they need for emergencies

Ignore asset allocation

Overlook diversification

Chase returns by switching products frequently

Convenience should not replace planning

Digital apps are tools not strategies

The biggest mistake many users make is assuming that downloading an investment app is the same as having an investment plan

Apps are delivery channels They do not define your goals risk tolerance or time horizon Without clarity users may move money reactively rather than strategically

Good investing still requires asking basic questions

What is this money for

When will I need it

How much risk can I tolerate

No app can answer these for you

The opportunity and the responsibility

Digital investment apps represent a major step forward for financial inclusion in Ghana They have opened doors that were previously closed to millions of people

But they also shift responsibility onto users The same tools that empower can mislead if used without understanding

For Ghanaians navigating an economy shaped by inflation volatility and lingering distrust digital investing should be approached with informed confidence not blind optimism

The future of investing in Ghana may well be digital But the fundamentals remain unchanged understand what you are buying know who you are trusting and never let convenience replace judgment

Long-term investing in Ghana myths realities and what patience really looks like

For many Ghanaians long-term investing feels almost unrealistic In an economy shaped by inflation currency depreciation policy shifts and periodic financial shocks the idea of locking money away for years can sound naïve even reckless Short-term survival often feels more urgent than long-term planning

Yet long-term investing remains one of the few proven ways individuals build durable wealth anywhere in the world including Ghana The problem is not the concept itself but the myths surrounding it and the mismatch between expectations and reality

Understanding what long-term investing truly means in the Ghanaian context is essential for anyone hoping to move beyond short-term financial firefighting

Myth one long-term investing does not work in Ghana

This is perhaps the most common belief Many people point to past losses failed schemes currency depreciation or market volatility as evidence that long-term investing is pointless locally

The reality is more nuanced What has often failed is not long-term investing but poorly structured investing Unregulated schemes concentrated bets and blind trust are not long-term strategies even if people stay invested for years

Proper long-term investing relies on regulated instruments diversification realistic expectations and patience When these are present time can still work in the investor’s favour even in a volatile economy

Myth two you need a lot of money to think long term

Another widespread misconception is that long-term investing is only for high earners In practice consistency matters far more than size

Many Ghanaians who successfully invest long term do so by contributing modest amounts regularly to pensions mutual funds or fixed-income instruments Over time compounding and discipline outweigh one-off large investments

Long-term investing is not about how much you start with It is about whether you stay invested through different economic cycles

Myth three long-term means locking money away forever

In Ghana the fear of illiquidity is justified Emergencies are frequent income can be unstable and access to funds matters

But long-term investing does not mean putting all your money out of reach It means separating money by purpose Emergency funds and short-term needs should remain liquid Long-term investments should be money you do not expect to touch soon

Problems arise when people invest money they cannot afford to leave alone That mistake turns normal market fluctuations into crises

The reality of volatility patience is not passive

Long-term investing in Ghana requires emotional resilience Markets move Interest rates change Returns fluctuate Some years look disappointing others outperform expectations

The key reality is that patience is active not passive It involves staying invested during uncomfortable periods rather than reacting emotionally to short-term noise

Many investors lose not because their investments fail but because they exit at the worst possible time

Currency risk changes the conversation

One reality that long-term investors in Ghana must confront honestly is currency risk The cedi’s long-term depreciation affects real returns especially for those measuring wealth in foreign currency terms

This does not make long-term local investing pointless but it does mean expectations must be adjusted Returns must be evaluated in real terms not just headline percentages

For some investors this means balancing local investments with assets denominated in stronger currencies For others it means focusing on income generation rather than capital appreciation alone

What long-term investing actually looks like in Ghana

In practice long-term investing in Ghana often involves a mix of instruments rather than a single bet

This may include

Pension contributions that benefit from tax advantages

Mutual funds invested across government securities bonds and equities

Select exposure to the Ghana Stock Exchange with a multi-year horizon

Periodic reinvestment of treasury bill proceeds

Gradual accumulation rather than lump-sum timing

The common thread is structure not speculation

Time smooths mistakes not bad decisions

One dangerous misunderstanding is the belief that time automatically fixes poor investment choices It does not

Time amplifies good decisions and exposes bad ones Unregulated schemes do not become safer with age Poor governance does not improve simply because money stays invested longer

Long-term investing rewards discipline and sound structure not hope

Why many people quit too early

Many Ghanaians abandon long-term investing after one or two disappointing years Inflation rises returns lag expectations or economic headlines turn negative

But long-term investing is measured in cycles not months Short-term underperformance is not failure it is part of the journey

Those who succeed tend to be the ones who separate emotions from strategy and understand that discomfort is normal

Long-term investing is a mindset before it is product

At its core long-term investing in Ghana is not about finding the perfect instrument It is about adopting a mindset that accepts uncertainty prioritises consistency and resists pressure for immediate results

It requires

Clear goals

Realistic timelines

Diversification

An understanding of risk

The discipline to stay invested

Without these even the best products will disappoint

The quiet truth about long-term wealth

In Ghana visible wealth often comes from business inheritance or sudden success Long-term investing is quieter It does not announce itself It grows slowly sometimes invisibly

That quiet nature makes it easy to dismiss But for those who persist it provides something rare in an uncertain economy gradual stability

Long-term investing in Ghana is not a myth But it is not magic either It demands patience structure and honesty about risks

For investors willing to think in years rather than months and progress rather than perfection it remains one of the few financial strategies that can outlast volatility and reward discipline in the long run